When a business launches a rewards program, it is critical to evaluate the impact of reward points on its financial statements.

In May 2014, the U.S. Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) jointly issued a standard on revenue recognition. This new, conjoined set of accounting standards is known as Accounting Standards Codification (ASC) Topic 606: Contracts with Customers, or, in its short form, ASC 606/IFRS 15 Accounting Standards.

US GAAP requires public entities to apply the revenue standard for annual reporting periods (including interim periods therein) beginning after December 15, 2017. Nonpublic entities reporting under US GAAP are required to apply the revenue standard for annual periods beginning after December 15, 2018.

Estimating Rewards Program Liability

Now that companies must defer revenue to cover the costs of rewards points. Also, being able to correctly anticipate breakage is more important than ever. How much revenue a business must defer corresponds significantly to its predicted breakage rates, so it’s essential that accounting departments have a reliable model of how redemptions will unfold.

The formula below demonstrates the role of breakage in anticipating the rewards program liability. Rewards program liability is also equal to the deferred revenue.

Outstanding Points = Points that have been issued but not yet redeemed or expired

Cost per Point = Expected cost of each point that will eventually be redeemed

Redemption Rate = Probability that a point will be redeemed

The formula for Redemption Rate is:

Redemption Rate also leads to the concept of breakage. Breakage is the percentage of unredeemed points (either issued or expired).

Breakage = 1 – Redemption Rate

Excerpts from ASC 606

Here’s an excerpt from the ASC 606, Example 52. See Grant Thornton guide, page 68 for details.

An entity has a customer loyalty program that rewards a customer with 1 customer loyalty point for every $10 of purchases. Each point is redeemable for a $1 discount on any future purchases of the entity’s products. During a reporting period, customers purchase products for $100,000 and earns 10,000 points that are redeemable for future purchases. The consideration is fixed, and the standalone selling price of the purchased products is $100,000. The entity expects 9,500 points to be redeemed. The entity estimates a standalone selling price of $0.95 per point (totaling $9,500) on the basis of the likelihood of redemption in accordance with paragraph 606-10-55-44.

Typical Redemption Rates and Rewards Liability

Due to threshold-based points systems and points expiration, we usually see a redemption rate of 30% or less. Assuming a maximum redemption rate of 30% and 10% payback in points, you will be deferring a maximum 3% of the revenue. The revenue gets recognized when points are redeemed. Typically, the deferred revenue to offset liability is in the range of 1% to 1.5%.

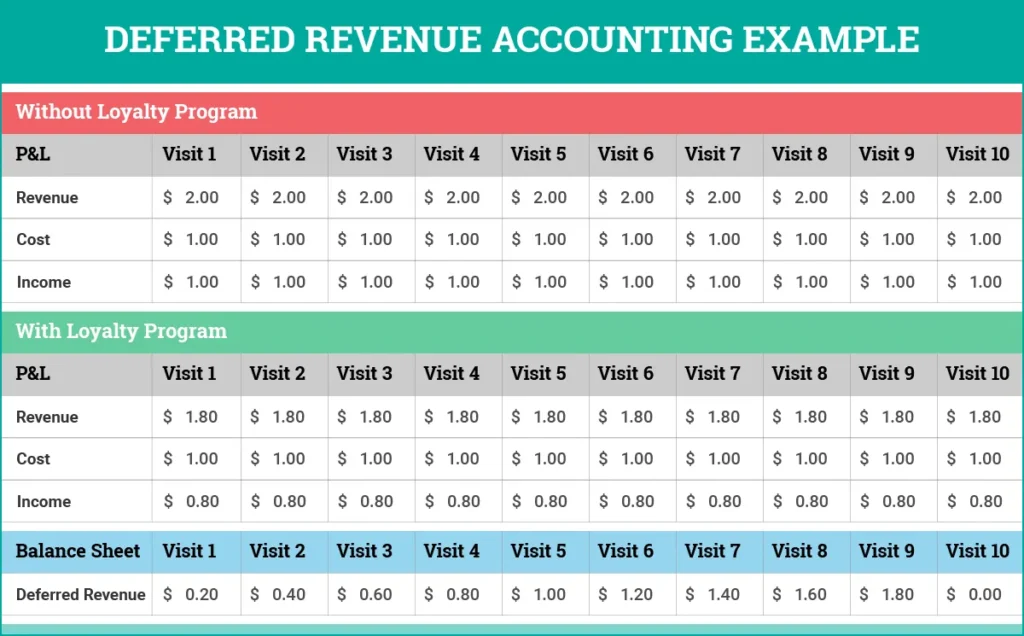

Deferred Revenue Accounting Example

Here’s a simple example of a coffee shop which gives you 10th coffee for free. The coffee is priced at $2 and the cost is $1.

On the 10th visit the deferred revenue is recognized. This chart assumes that the redemption rate is 100%. If the redemption rate was 30%, the deferred revenue would be $0.06 instead or $0.20. If the redemption rate was 15%, the deferred revenue would be $0.03.

Typically, rewards programs have redemption rates between 15-30%. Of course, the actual rates will vary by industry and business.

Summary

With the introduction of Accounting Standards Codification ASC 606, the liability incurred by rewards program is becoming an increasingly important topic. A successful rewards program maximizes redemption rate while minimizing liability.

See 5 Strategies to Minimize Liability from Rewards Programs.