Ever wondered if you can quantify the value of a repeat customer, specifically for your business? Can you apply a simple mathematical model to quantify the value of a repeat customer for repeat business?

Yes, you can with this simple formula. Just a few numbers to get you started! In this article, we will introduce a key concept, Repeat Customer Leverage (RCL),to help estimate the value of a repeat customer specifically for your business.

Repeat Customer Leverage

Take the case of a company, Acme. Suppose,

You can find these x and y values from your internal business metrics, or if you are an eCommerce business, it can be found in the Audience Behavior – New vs Repeat Section in Google Analytics.

Then,

First, we measure the efficiency with which repeat customers generate revenues. It is simply the percentage of repeat revenues divided by the percentage of repeat customers.

Next, we measure the efficiency with which one-time customers generate revenues. It is simply the percentage of one-time customer revenues by the percentage of one-time customers.

Then, we measure the relative efficiency with which repeat customers generate revenues compared to one-time customers. This relative efficiency is the Repeat Customer Leverage (RCL), or the relative value of a repeat customer compared to a one-time customer for that specific business.

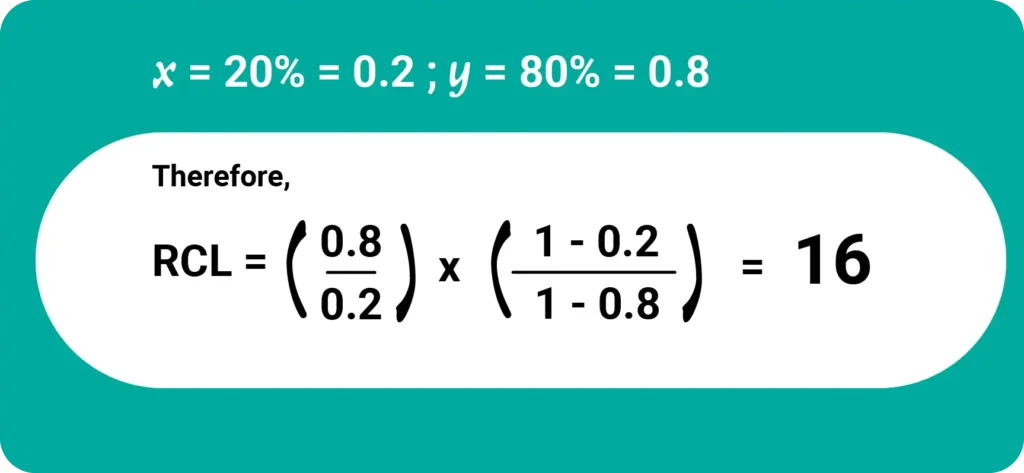

Let’s take a look at the importance of RCL. Chances are, you may have heard about the 80-20 rule, or the Pareto Principle. The Pareto Principle is also applied to marketing where it states that 20 percent of your customers represent 80 percent of your sales. For a business whose distribution follows the Pareto distribution, the value of RCL is computed as follows.

Therefore, if the repeat customer distribution of a business follows the 80-20 Pareto principle, a repeat customer is 16 times more valuable than a one-time customer. Any one-time customer converted into a repeat customer will generate revenues 16 times more efficiently for the business. Similarly, if a business has a 90-10 distribution, where 10% of repeat customers generate 90% of the revenues, the RCL value is 81. For such a business, a repeat customer is 81 times more valuable!

A simple, easy to use value calculator can help you get started to compute the value of RCL for specifically for your business.

Less convincing required = less marketing expenditure. A study conducted by Boston Consulting Group states that the average cost of marketing to existing customers is about $7 whereas the marketing cost per new customer averages at around $34. Way too much time and money is spent on new customer acquisition without a sense of when to start focusing on customer retention.

The choice is yours, spend additional dollars on getting new customers or focus on the customers you have. But measuring Repeat Customer Leverage (RCL)is a great way to determine the value of a repeat customer relative to a one-time customer.

The higher the value of RCL, the higher the effort that should be put in to convert your one-time customers into repeat customers. Loyalty rewards is a proven strategy to convert one-time customers into repeat customers.