With the introduction of Accounting Standards Codification ASC 606, the liability incurred by rewards programs is becoming an increasingly important topic.

The liability of a loyalty rewards program is minimized when the redemption rates are low i.e. the breakage is high. However, if the redemption rates are low, it also means that customers are not redeeming rewards points and therefore, it decreases the effectiveness of the rewards program. Therefore, it is a delicate balance between the minimization of liability and the maximization of rewards program effectiveness.

A great loyalty rewards program is designed to minimize loyalty program liability while maximizing the redemption rate.

Top 5 Strategies to Minimize Rewards Program Liability Effectively

1. Expire Points

Expire points after a fixed time period after they are earned, typically, 12 months. Users can renew the validity of their points by making another purchase. This is a great incentive for users to make another purchase within a deadline.

Reminder emails about point expiry act as a catalyst for the user to make a purchase.

2. Auto-Redeem Points

Auto redeem points and convert them into expirable coupon codes. For example, if a $10 coupon is redeemable for 1,000 points, convert the points into an expirable $10 coupon automatically when the user accumulates 1,000 points. This will encourage users to make another purchase using this coupon code.

3. Tiered Loyalty Programs

Instead of points being redeemable for coupons, points could only count towards status in a tiered customer loyalty program. The status can then be used to deliver special privileges to the user.

For example, Icebreaker, a premium sports clothing brand, uses points only to determine the customer tiers.

Users earn special gift certificates and privileges when they reach a certain tier. However, points are never directly associated with a cash value. This enables Icebreaker to offer a Tiered Loyalty program without directly incurring a points liability.

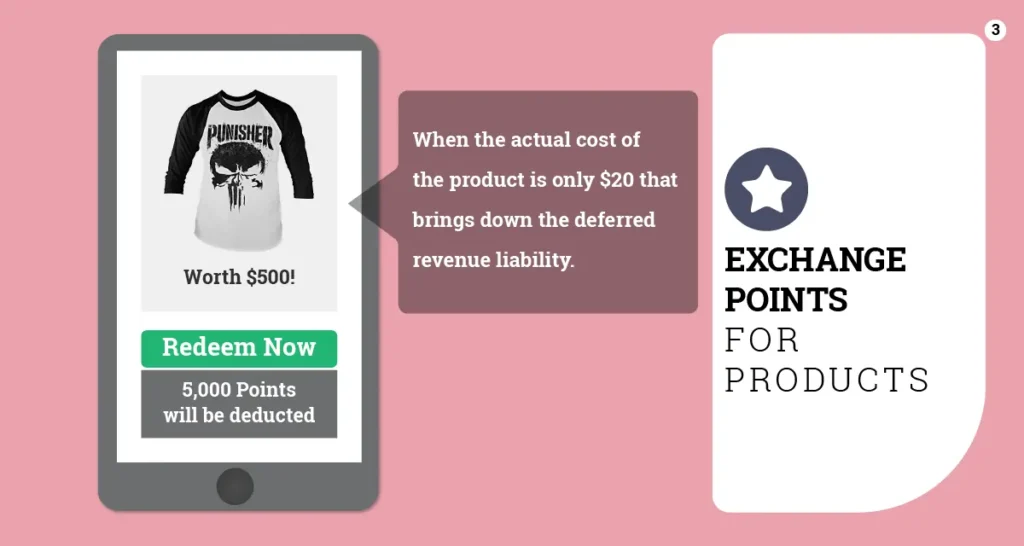

4. Exchange Points for Products

Allow users to exchange products for points. This strategy is used to exchange points for high perceived-value products which actually cost very little.

For example, if a user was allowed to redeem 5,000 points for a product valued at $500 when the actual cost of the product is only $20 that brings down the deferred revenue liability.

5. Sweepstakes Entries

Allow users to redeem points to buy sweepstakes entries. Users can buy as many sweepstakes entries as they want. This is a great way to engage users and reduce the points liability without offering a substantial cash value per point.

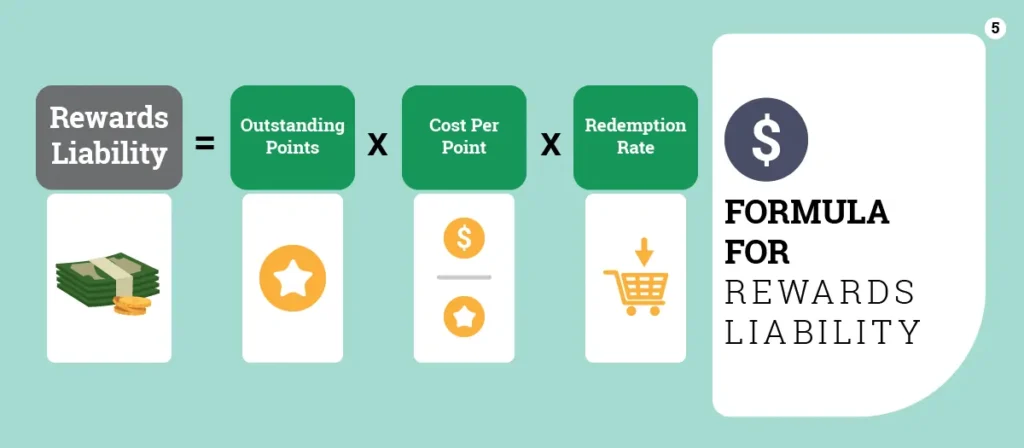

Cost per Point is Important. Note the formula for Loyalty Program Liability –

A good loyalty rewards program maximizes the redemption rate. Therefore, the only way to minimize the Rewards Liability is to minimize the Cost per Point.

The trick is to minimize Cost per Point while maximizing the perceived Value per Point.

Conclusion

A successful loyalty rewards program should always have a high redemption rate. Rewards that maximize the perceived value of points while minimizing actual cost will decrease the liability of the rewards program.